There are many financial advisors in Kansas City that can help you. These are just a few: Prairie Capital Management; Windward Private Wealth Management; Atwood & Palmer; and Fortune Financial. These firms are experts in various aspects of financial planning.

Prairie Capital Management

Prairie Capital Management, a financial advisory company located in Kansas City (Missouri), is Prairie Capital Management. They manage assets totaling $6.2 million and oversee assets of 2,528 accounts. Their clients include high-net-worth individuals, corporations, and pooled investment vehicles. They also manage 401(k) plans, IRAs, and estates. The firm does not act as a registered broker-dealer or investment advisor, but it does act as a custodian.

Prairie Capital Management's fees vary depending on what services they offer to their clients. Typically, fees are a blend of different fee types, including asset-based fees, hourly fees, and fixed or performance-based fees. Prairie Capital Management can help with your financial planning, no matter how simple or complex.

Windward Private Wealth Management

Windward Private Wealth Management has two offices in North Kansas City. Their professionals work with clients to protect and analyze their portfolio valuations. Owner and founder Darrell Windward has more than three decades of experience and specializes in helping clients achieve their financial goals. His clients also benefit from his expertise in helping to save taxes and preserve capital.

Windward Private Wealth Management is focused on helping clients achieve their financial goals and feel financial freedom. They provide comprehensive financial planning, tax preparation and investment management. The firm provides relationship management and can link clients with other business professionals. Its team includes a Certified Financial Planner, (CFP), and a lead plan.

Atwood & Palmer

Atwood & Palmer, Inc is a financial advisor firm in Kansas City, Missouri. They manage 435 client accounts, $1.3 billion of assets. Their staff consists of five financial advisors. They are registered as an investment adviser and not as a broker-dealer. Securities are an exchangable form of financial assets.

There are many fee options available to the firm. Fixed-fee and asset-based models are offered. This fee structure aligns both the interests of the client and the advisor. This fee structure doesn't include brokerage commissions or interest.

Fortune Financial

Founded more than a decade ago, Fortune Financial Advisors in Kansas City provides comprehensive wealth management services for individuals, businesses, and families. The firm's financial advisors specialize in devising strategies to help clients reach their financial goals. They are experts in business consulting, fiduciary service, retirement planning, career goal setting, and business consulting.

The firm offers fee-only financial planning services for clients, as well as multiple investment services. The firm's advisors offer one-stop financial solutions, integrating all clients' financial needs into an individual holistic plan.

FAQ

Why hire consultants?

There are many reasons why you might need to hire consultants:

-

You may have a problem or project that your organization needs to solve.

-

You want to increase your skills and learn something new

-

It is important to work with an expert on a subject area

-

The task is yours alone.

-

Feel overwhelmed by all the information available and don't know where you should start

-

You can't afford to pay someone full-time

You can find good consultants by word of mouth. Ask around if anyone knows any reputable consultants. Ask someone you know who is a consultant for his/her recommendations.

If you decide to use online directories like LinkedIn, use the "Search People" feature to look for consultants in your area.

How much do consultants make?

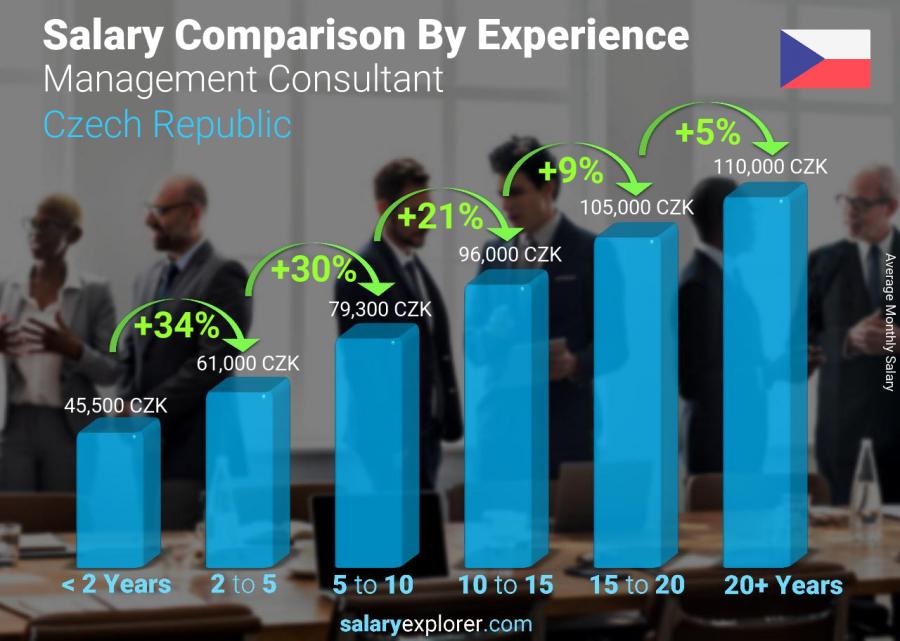

While some consultants may make over $100k per annum, most consultants earn between $25k and $50k. The average consultant salary is $39,000 This applies to both hourly and salaried consultants.

Salary depends on experience, location, industry, type of contract (contractor vs. employee), and whether the consultant has his/her own office or works remotely.

What qualifications do you need to be a consultant?

It's not enough just to have an MBA degree; you must also demonstrate experience working as a business consultant. A minimum of two years' experience in consulting, training and/or advising a major company is necessary.

It is essential that you have experience working closely with senior management on strategic development projects. This requires you to feel confident presenting ideas to clients, and getting buy-in.

Additionally, you will need to pass a professional qualification such as the Chartered Management Institute Certified Management Consultant (CMC).

Statistics

- 67% of consultants start their consulting businesses after quitting their jobs, while 33% start while they're still at their jobs. (consultingsuccess.com)

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

External Links

How To

How can I start my own consulting business?

A simple and effective way to get started with your own consultancy business - without any capital investment!

In this tutorial, you'll learn how to make money online while working from home, improve your skills, earn some extra cash, and become successful.

Here are some secrets to help you get traffic on demand.

This method is known as "Targeted Traffic". This is the method that was created to enable you to do such things.

-

Find out what niche you want.

-

Find out which keywords are used by people to search for solutions on Google.

-

Write content that uses these keywords.

-

Post your articles on article directories.

-

Use social media sites to promote your articles.

-

Create relationships with experts in this niche.

-

You can be featured on these websites and blogs.

-

Grow your email list by sending out emails.

-

Start making money.